What is an Embedded Lending?

Embedded finance is an innovative concept that is expected to revolutionize the financial sector in the future. It involves merging financial products or services with non-financial businesses or platforms.

This article will delve deeper into embedded finance and its potential benefits for companies that choose to implement it.

As e-commerce platforms continue to grow and expand, they face increasing competition from a more significant number of providers. To attract and retain individual and business customers, companies are focusing more on enhancing the customer experience and developing a seamless customer journey while providing high service levels. This has led to a rise in embedded finance, a concept where financial products or services are merged with non-financial businesses or platforms.

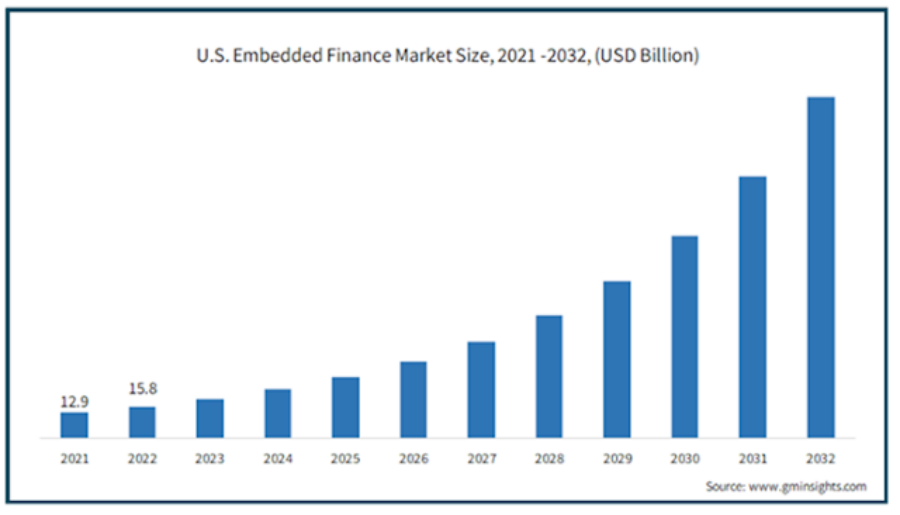

According to industry-report publisher Global Markets Insight, the embedded finance industry is expected to grow steadily over the forecast period, recording a compound annual growth rate of 23.9% during 2022-2029. Leading entrepreneurs have already started to embed financial services into their offerings, and this trend is only set to continue in the near future.

In the context of lending, embedded finance has revolutionized the way people access credit. Buy-now-pay-later or embedded lending is a prime example. BNPLs or online shopping credit allow consumers to make purchases and defer payments or pay in installments without directly dealing with a bank or undergoing the traditional loan approval process.

By integrating BNPL options based on advanced financial technology like ready-made loan origination systems, businesses can offer in-house financing directly and extended credit terms to their customers, thus enhancing customer experience and increasing loyalty.

Our platform is easily integrated with existing systems and can be customized to meet your specific needs, enabling business growth and providing quick access to new revenue streams.

What are the Benefits of Embedded Finance for Merchants?

→ Increased conversation rate

Shopping cart abandonment is a common problem for eCommerce businesses. One of the main reasons for this is insufficient funds at the time of checkout. However, embedded lending can help solve this issue by providing customers with point-of-sale credit.

By integrating ‘buy-now-pay-later’ lending services directly into the checkout process, e-commerce platforms can reduce friction in purchasing decisions, leading to increased sales and conversion rates. Offering flexible payment options through embedded lending attracts new customers who prefer alternative payment methods or need financing, encouraging repeat purchases and customer loyalty. It also provides a viable and friendly alternative to the traditional banking system, unlocking new customer bases and revenue streams, streamlining the customer journey, and positioning companies as more customer-centric and accommodating to varied financial needs.

→ Enhanced Customer Acquisition and Retention:

Offering flexible payment options through embedded lending attracts new customers who prefer alternative payment methods or need financing options. Moreover, it encourages repeat purchases and customer loyalty by providing a convenient and seamless shopping experience.

→ Competitive Advantage

Companies wanting to stay competitive in the modern market must focus on providing a seamless customer journey. To do so, they should consider integrating financial services into their offerings. By embedding financial products into accessible platforms that individuals and businesses can easily access, merchants can provide a viable and friendly alternative to the traditional banking system, unlocking new customer bases and revenue streams. This not only streamlines the customer journey but also sets companies apart from competitors and positions them as more customer-centric and accommodating to varied financial needs.

→ Expanded Market Reach

Embedded lending can also attract customers who need more financial means to make immediate purchases, widening the customer base to include those who prefer installment payments or have limited access to traditional credit. Embedded lending minimizes cart abandonment rates and encourages customers to complete their purchases by providing installment or deferred payment options. Integrating lending services directly into the e-commerce platform simplifies the purchasing process, allowing customers to apply for credit or financing without leaving the site and avoiding additional steps or redirection to external financial institutions.

→ Streamlined User Experience

Integrating lending services directly into the e-commerce platform simplifies the purchasing process. Customers can apply for credit or financing without leaving the site, avoiding additional steps or redirection to external financial institutions.

→ Data Utilization for Personalization

Moreover, embedded lending collects data on customer purchasing behavior and payment preferences, which e-commerce platforms can leverage to personalize offers, improve product recommendations, and tailor marketing strategies to individual customer needs. Collaboration with lending institutions or fintech companies to offer embedded lending services can lead to strategic partnerships, providing additional revenue streams for e-commerce platforms.

Embedded lending offers several advantages for e-commerce platforms, enabling them to enhance customer experiences and drive business growth:

Most Popular Business Models within Embedded Finance

Models representing various ways of integrating financial services into non-financial platforms. They cater to diverse needs and enhance user experiences across different industries. Their popularity grows as technology advances and consumer demands for seamless, convenient financial solutions increase.

→ Buy-Now-Pay-Later (BNPL):

• Buy Now Pay Later (BNPL) is becoming a popular payment method for businesses that offer high-value and luxury goods, car parts and services, medical and home improvement products, and much more.

• It allows customers to shop products now and pay for them later in installments, making it a convenient option for those who cannot afford to pay the total amount upfront.

• Equipment and asset leasing – Equipment and asset leasing is a financial model that facilitates the acquisition of costly machinery, vehicles, computers, or other essential assets for businesses without the need for upfront capital investment. This model is trendy among manufacturing companies and equipment providers.

• Equipment and asset leasing offers businesses a way to access necessary equipment without the immediate financial burden of purchasing. It’s a strategic financial tool that aligns with diverse industries’ operational needs and growth strategies.

• Merchant cash advance –In a special kind of loan model called MCA, borrowers repay a percentage of their sales every day or week until they pay off their entire debt. Merchants can integrate Compassway solutions with their online shopping platforms to make this process easier and safer. This way, merchants don’t have to manually submit their invoices, which can be slow and insecure. Instead, the Compassway platform automatically calculates the repayments, making things simpler and more reliable for everyone involved.

• API-driven Financial Services:

• Application programming interfaces (APIs) play a crucial role in embedded finance. They facilitate the seamless integration of financial services into existing platforms, enable easy access to financial products and services, and allow for innovation and customization.

7 Steps to Start Your Buy-Now-Pay-Later Solution

To establish your Buy-Now-Pay-Later (BNPL) services successfully, several key steps and customizable features are integral to its implementation:

Step 1. White-Label Solution Customization

– Choose a fully white-label system that allows you to brand the BNPL solution according to your design and color schemes, maintaining consistency with your brand identity.

– Ensure the flexibility to customize various aspects such as logos, user interface elements, and messaging to align with your brand’s aesthetics and tone.

Step 2. Tailored Solutions for Different Business Domains

– Create specialized versions of the BNPL solution for distinct business sectors, such as retail, automotive, or medical. Each version should accommodate specific industry needs and regulations.

– Custom features, terms, and payment structures tailored to the requirements of each domain ensure optimal usability and compliance.

Step 3. Loan origination process

– Implement a user-friendly loan application form integrated seamlessly into your website’s customer journey. Ensure it is configurable to adapt to business domains while maintaining a consistent user experience.

– Customize the application form fields to gather relevant information for credit assessment and decision-making.

-Automate compliance processes like KYC /AML

Step 4. Automated or Manual Credit Decisions

– Enable the BNPL solution to offer automated and manual credit decision processes. Automatic decisions can be based on predefined criteria and algorithms, while manual decisions involve human assessment for unique cases or exceptions.

– Allow flexibility to adjust credit decision thresholds based on risk tolerance and customer segments.

Step 5 Approval and Down Payment Collection

– Design the system to efficiently process and approve financing in real-time or with minimal delay to ensure a smooth customer experience.

– Incorporate functionalities for collecting down payments as part of the approval process, securing customer commitment, and minimizing default risks.

Step 6. Customer Support and Accessibility

– Implement robust customer support channels within the BNPL solution to assist users throughout the application, approval, and payment process.

– Ensure accessibility across various devices and platforms to reach a wider audience and facilitate easy access to the BNPL solution.

Step 7. Continuous Monitoring and Optimization:

– Regularly monitor the BNPL solution’s performance, gather user feedback, and analyze data to make necessary improvements and optimizations.

– Stay updated with industry trends, technological advancements, and regulatory changes to adapt the solution accordingly and maintain its relevance and effectiveness.

Launching a successful BNPL solution involves meticulous customization, compliance adherence, user-centric design, and continuous refinement to meet the diverse needs of customers across different business sectors.

Final Thoughts

Retailers have already seen the benefits of offering Buy Now Pay Later (BNPL) products. These products generate higher return on investment (ROI), drive sales, and improve customer satisfaction. BNPL also helps businesses reach a broader spectrum of customers with varied financial preferences and capabilities, allowing them to offer effective credit products and provide credit to customers who may not have access otherwise.

We help businesses launch their own embedded credit products with our end-to-end software and risk management stack. Our solution can be up and running in just three weeks, and we offer a free 15-day trial to help you understand the functionality of our BNPL solution.

Contact us to arrange a demo, answer questions, and discuss how CompassWay can help grow your business.